Analyzing Vanguard Core International Stock Fund

$VWICX: A New International Vanguard Fund managed by Wellington

First, let’s take a look at some of the options that I consider best. I’ve included $VIGAX for comparison, but it’s not something I’m looking to buy this year… or any year, really. In the 2010’s, I used it a lot. I think it’s time for international value, though.

You be the judge…

YTD performance as of 6PM 2/16:

$VWICX (Vanguard Core International Stock) +3.09%

$VFIAX (Vanguard 500) -5.95%

$VIGAX (Vanguard Growth Index) -10.9% (ouch!)

$VTMGX (Vanguard Developed Markets) -2.62%

$VTIAX (Vanguard Total International Stock) -1.37%

Some more ideas, but uncharted:

$VTRIX (Vanguard International Value) +1.97%

$VVIAX (Vanguard Value Index) -0.7% (not charted)

$DODFX (Dodge & Cox International Stock Fund) +5.01%

$FIVLX (Fidelity International Value) +2.58%

$GCOW (Pacer Global Cash Cowz) +7.56%

$COWZ (Pacer US Cash Cowz 100) +3.10%

$EFV (iShares EAFE Value) +5.18%

$IDV (iShares International Select Dividend) +6.29%

That’s some pretty incredible performance if you ask me.

Mood: Invest, index, and chill.

2022 Allocations (or: How to Sleep At Night)

The goal is to find MY ideal allocation. Yours may be different. This means, eventually, getting all of my funds set up under Vanguard. For now, I have some funds with TD and Fidelity, which makes balancing everything much more difficult, given I have to balance my 401k with everything as well.

This also means diversifying properly outside of the US, adding value-tilting that fits my unique preferences, and even taking a position in cash/bonds as needed. I like to divide age by 4 or 5 to come up with an ideal % allocation toward cash/treasuries. Right now, I’d do a mix of cash and ultra-short duration treasuries. Nick Murray advocates for 100% equity exposure long into an investor’s lifetime.

Vanguard and Active Management

Actively managed funds from Vanguard are thought-provoking, at the very least. Bogle, Vanguard’s founder, always railed against high-fee and active funds, as so few have ever gone on to beat the S&P 500 or ACWI in the long-run. I do believe he was right. That said, Vanguard has managed to be the #1-ranked provider of actively managed funds over the past 10 years, as ranked by Barron’s. Their funds consistently rank in the bottom 5th quintile for fees and have outpaced their rivals.

Link: advisors.vanguard.com/insights/article/barronsawardsvanguardactivetopmarks

However, with the world tilting more and more toward high-attention growth stocks, I wanted some solutions that would dodge some of the high-flying stocks. Unfortunately, the only fully value-oriented ex-US fund with Vanguard is $VTRIX. It’s an excellent fund, but I’m not trying to lean into value *too* hard.

$VWICX has a factor loading that complements the S&P 500 incredibly well. Let me illustrate.

First, let’s look at $VTWAX which holds the entire world of stocks:

This leaves us with a tilt toward growth, one which isn’t too bad.

When we look at the S&P 500, the growth tilt is more pronounced. Here’s $VFIAX or the Vanguard 500:

43% in growth with only 32% blend and 25% value. That’s quite a skew and makes the S&P a bit top-heavy, too.

As I don’t plan on selling any more of my S&P 500 holdings, I wanted to ensure my international exposure was properly hedging against an overweight exposure to growth.

Here’s the factor loading for $VWICX:

Wow! 37% in value and 11% in growth with 53% falling in “blend”. Not only is the fund beating its benchmarks, both value and growth, it’s doing so with a decently heavy value-tilt. Not quite like a value fund (which has 0% growth), but the managers have put together a portfolio that I really, REALLY like.

This let’s me get my energy exposure internationally, and by using $VFTAX (Vanguard FTSE Social Index) for the US, I can strip out energy entirely, but this leaves quite a lot of the fund in growth. $COWZ gives me midcap and large cap energy names and value, helping to round out a combination of S&P 500 / $VFTAX.

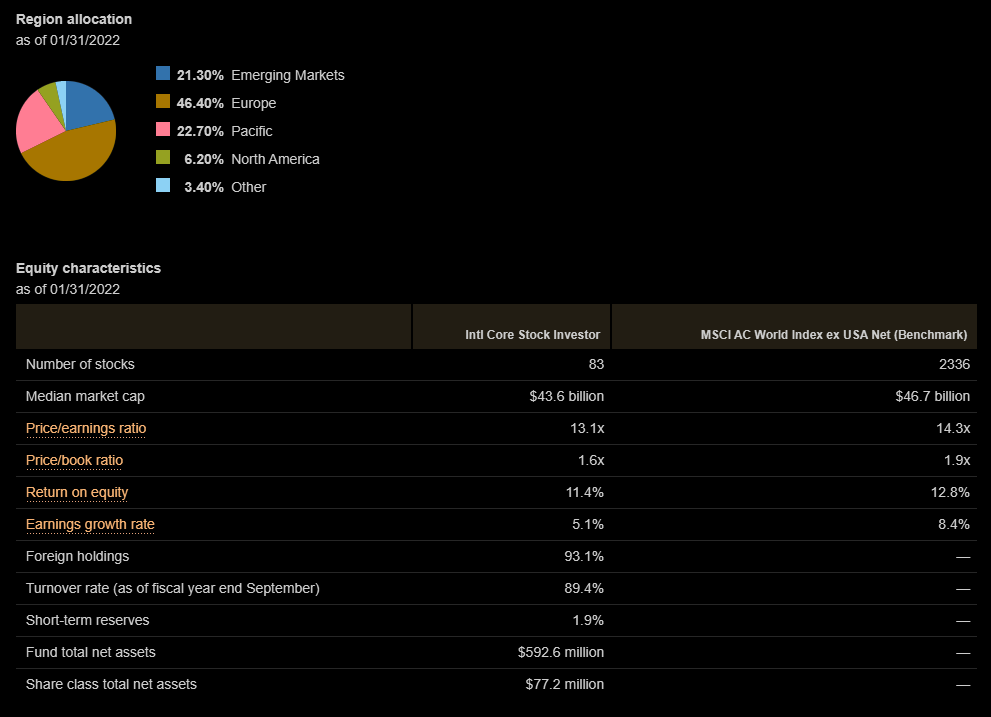

So, what’s in $VWICX anyway? It only has 82 holdings.

The top holdings include $VEA for liquidity, which lets it maintain DM exposure without being disrupted by fund redemptions. The manager can just sell $VEA to generate cash.

At the top of the equity allocation, we have $TSM, Samsung, Nestle, Shell, Roche, Airbus, RBC, Walmart Mexico, AXA SA, Novartis, Brookfield AM, WPP plc, TOTAL SA, Siemens AG, and Tokio Marine. It even has Barrick $GOLD. They really let the managers pick anything they wanted here. As a FM/PM, this looks incredibly modern and progressive.

The fund is single-handedly operated by Wellington Management, Vanguard’s most successful and oldest active equity management group. This makes the fund a bit more expensive, as Vanguard’s Quant team isn’t involved. (VG’s Quant team often takes a portion of a fund and allocates it quantitatively, which reduces costs while often boosting the fund’s performance through a smattering of many small holdings.)

Wellington is keeping things simple with only 82 holdings, each of which their managers are intimately familiar with. This is quite obvious when you see which “growth” companies they added. It’s nice to see TSM, Samsung, Airbus and others. AZN is in there, but they have it near the bottom of the holdings, with only $3m allocated.

Very interesting!

The portfolio has 21.3% exposure to EM, while foregoing all the “ridiculous” Chinese stocks that I don’t really want.

The rest of the holdings contain some excellent selections. Even AerCap makes an appearance with a $6.55m allocation. Color me fascinated.

Smaller holdings round out the fund, but this just looks like a big old “flex” from Wellington Management. They’ve survived every single market downturn thrown at them. Maybe I have a bit more faith in active management than I should, but without Vanguard value index for ex-US, it’s either this or $VTRIX, or EM Select Stock (which I will review later).

Some more data from Morningstar:

As a new fund, there’s no write-up yet from the Morningstar team. Despite using the ex-US ACWI as a benchmark (rather than value), the fund has dealt with 100% upside capture and only 98% downside capture.

And as such, I’ve been holding this one for a while and have been impressed with the returns. For more value-oriented options, $VTRIX and $DODFX are my next two favorite picks in the Large International Value “category”.

I consider this all an act of rebalancing, allocation, and diversification. I simply can’t afford to have 10% of my assets in $AAPL, or 31% in US tech stocks. I believe the market will teach everyone this lesson in 2022 and beyond.

Ideally, I’ll be able to settle on pure index funds, but I do believe growth has become significantly overvalued in the wake of 3+ years of commission-free trading and a decade of US stock market outperformance. I shouldn’t be taking any uncompensated risk, especially as I get a bit older.

As such, my “final form” will hopefully be simply putting my funds entirely into $VTWAX and slowly putting more into cash/treasuries. In the end, I think This Is The Only True Path Forward, So To Speak. Or, “TitOTPFSTS” if you prefer.

As always, thanks for reading!

—Avery

P.S. Zoltan Poszar’s latest notes are particularly infuriating, and seem designed to scare Schwab clientele out of their positions. There’s probably more than one reason, but ~50% of Schwab clients “panicked” in March 2020, being net sellers of equities. This compares with ~2% of Vanguard clients who “changed allocations” (no numbers of “panicking”, but it’s a max of 2%).

The more we trade, the worse our portfolios perform. This is an indisputable fact.

Who knows if they ever got back into the market. I don’t even want to know.

I think much of the overtrading/panicking can be explained by the bombardment of info/data and flashing numbers you get with certain brokerages. I think this is evil, and preys of investor psychology and our very-flawed yet natural inclinations as human beings. Investing is dominantly defined by behavior, as I covered in a previous Substack piece on Behavioral Investment Counselling.

The less we look at our portfolios, the better we do! (Richard Thaler) Looking at the market isn’t even necessary for indexing, anyway. Let’s resolve to take a more relaxed approach to markets and focus on saving, and letting the game “play itself”. The goal is financial independence and removing stress and bad behavior from our portfolios.