Bullard Wants a Supersized Hike

James Bullard says he supports raising rates by a full percentage point by July

“I’d like to see 100 basis points in the bag by July 1,” Bullard, a voter on monetary policy this year, said in an interview with Bloomberg News on Thursday. “I was already more hawkish but I have pulled up dramatically what I think the committee should do.”

Bullard wants to spread the hikes over three meetings and shrink the Fed Balance sheet starting in Q2, followed by rate-path decisions for the second half of 2022 based on updated data. He has said he’s undecided on whether the March meeting should start with a +50bp hike, and that he would “Defer to Fed Chair Jerome Powell in leading the discussion”. Bullard is consider quite hawkish.

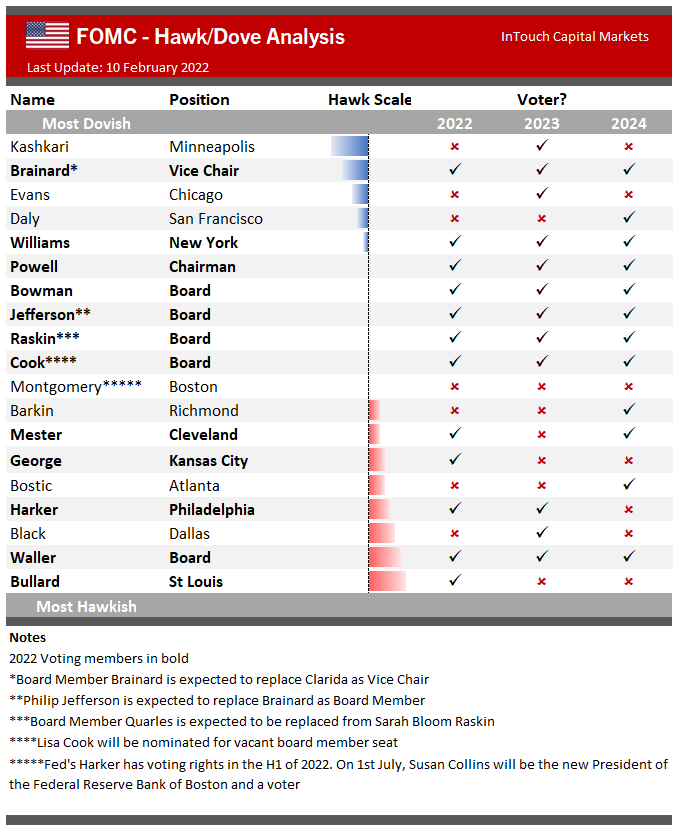

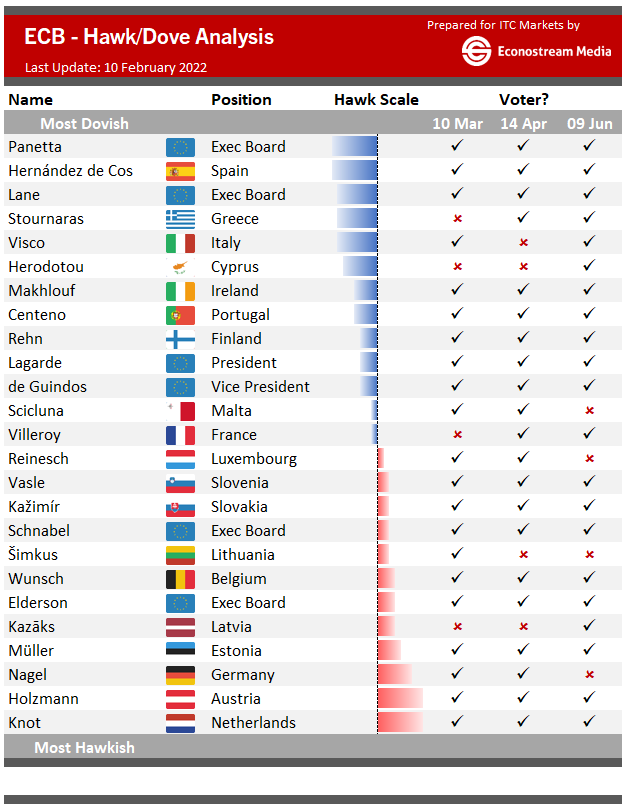

Here are some “cheat sheets” if you’re wondering who’s considered hawkish/dovvish and who, exactly, is voting. I’ve included the FOMC and ECB “superinfluencers”:

FOMC Hawk/Dove Analysis:

ECB Hawk/Dove Analysis:

Source: itcmarkets.com

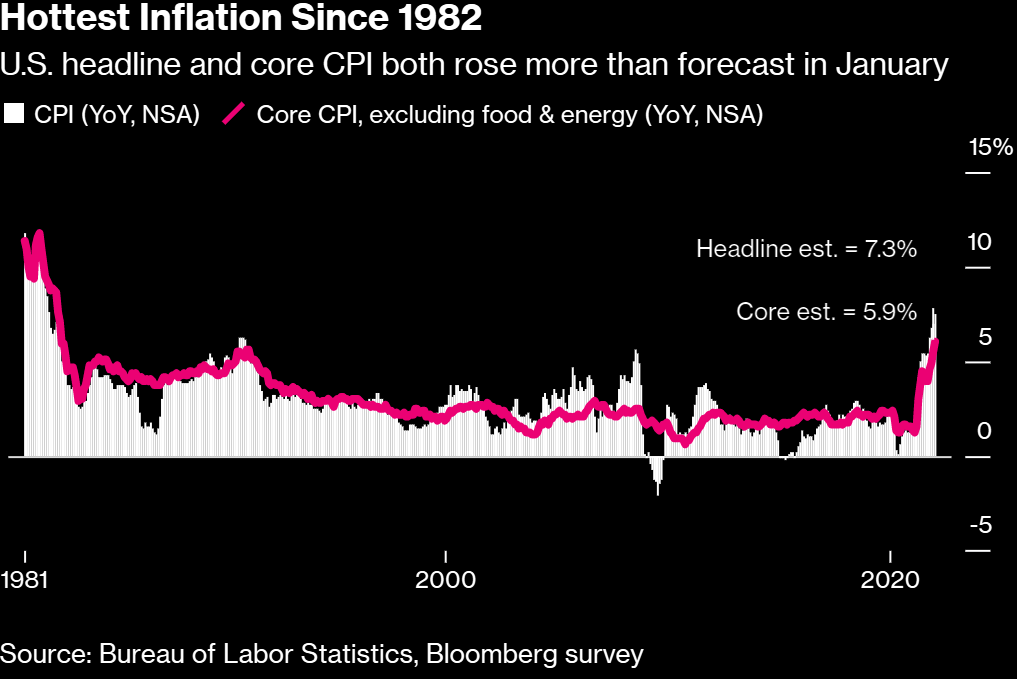

Inflation is running hot, REAL hot. 7.3% YoY, the highest since 1982. If you don’t remember, Volcker let rates “float” in the 80’s, which saw an 18-handle on bond yields for the first time since Ancient Egypt. I think.

#USYC2Y10

US Treasury 10y-2y curve as of 9:14am today:

The question is: Can the Fed hike rates aggressively without causing a recession? Are we already in for a recession? It seems like the average American is getting paid less in real terms, while paying more for consumer staples.

I expect some belt-tightening as consumers come to terms with the prospect of sticky inflation.

Flex CPI is off the charts, we’ll just have to hope it falls, but this move is not one that can be ignored.

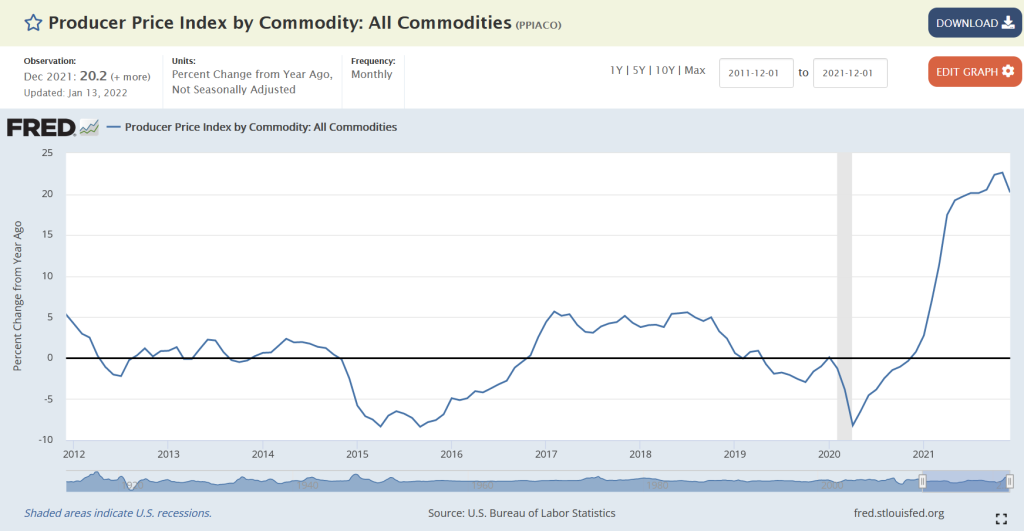

PPI for all commodities is up 20% YoY. Pretty astonishing (as of Dec 2021!)

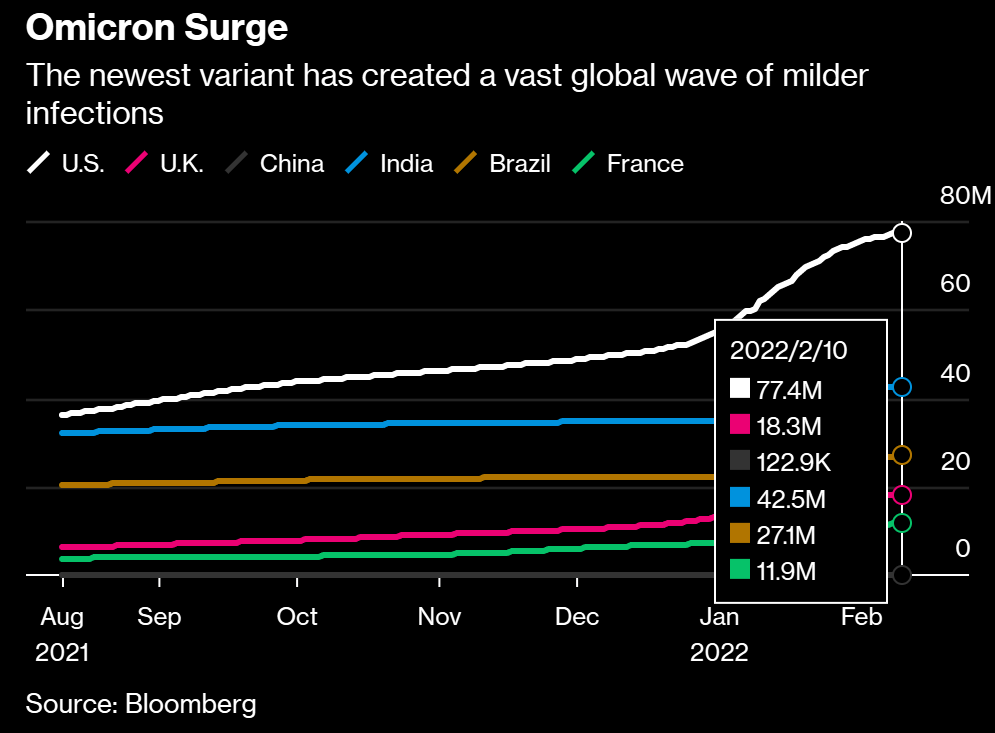

We’re also seeing a surge in Omicron, whether you believe it or not.

I’ve found the Boston Deer Island Treatment Plant surveys to be highly predictive of the future path of new variants, and we’ve finally seen viral loads dropping in recent days. Thanks to @BigDaddyDollarz for sharing this:

This cuts all the reporting nonsense and simply looks at the viral loading of wastewater samples at the treatment facility.

Will we make it? I think the virus is here to stay, and politicians and corporate types seem to be on the warpath for “let’s go back to normal”. Nothing will be “normal” ever again, so long as people think we can return to 2019.

At least the Nasdaq is having a green red green red green red green day today. I’d be selling it here. In fact, I did; sold my last few shares of $QQQ during the opening drive as #NQ_F pushed into the 14300’s and is attempting to head back there now.

Nasdaq strength over a number of trading sessions is something we should want to see, even if we’re not holding it. (The S&P is much safer, if you can’t tolerate value).

Honestly, this doesn’t look like a fun trade at all. Unless your first name is “Citadel” or “Virtu”, perhaps.

Quickly going back to Russia:

Putin Signals Talks With U.S. to Go On as Some Drills End

Lavrov says some Western proposals are ‘constructive’

Russia to continue diplomacy as U.S. calls for de-escalation

Envoy says concessions available, but not on NATO bid

Major share markets rattled, oil surges to nine-year high

Germany's Scholz in Kyiv, then Moscow on Tuesday

G7 says invasion will trigger 'massive' economic reprisals

Putin tells Biden U.S. response does not meet Russian demands

bloomberg.com/news/articles/2022-02-14/putin-signals-talks-with-u-s-nato-to-continue-amid-crisis

reuters.com/world/europe/ukraine-hints-concessions-russia-scholz-heads-region-2022-02-14/

Be careful out there.

—Avery