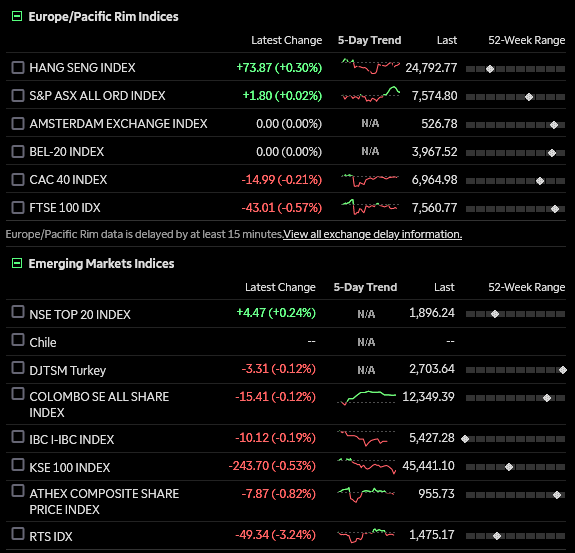

Good morning! I’m waking up a bit late and just starting my coffee, but let’s quickly go over foreign markets. It looks like US equities will be opening down

Kyiv, West fear 'pretexts for invasion' after shelling in east Ukraine

An interior view shows a kindergarten, which according to Ukraine's military officials was damaged by shelling, in Stanytsia Luhanska in the Luhansk region, Ukraine, in this handout picture released February 17, 2022. Press Service of the Joint Forces Operation/Handout via REUTERS

“MOSCOW/KYIV, Feb 17 (Reuters) - Kyiv and its Western allies said they feared that Russia might be trying to create a pretext to unleash war on Thursday, after reports of shelling across the front line in Ukraine's longstanding conflict with Moscow-backed separatists.

Ukraine and the pro-Russian rebels gave conflicting accounts of Thursday's shelling and the details could not be established independently. The reports from both sides suggested an incident more serious than the ceasefire violations that are regularly reported on the line of contact in eastern Ukraine's Donbass.

Ukraine's President Volodymyr Zelenskiy said the pro-Russian forces had shelled a kindergarten, in what he called a "big provocation". For its part, the Kremlin said Moscow was "seriously concerned" about reports of an escalation after the separatists accused government forces of opening fire on their territory four times in the past 24 hours.” (Link)

European Union leaders discussed the Russia tensions in Brussels, ahead of a meeting of Group of Seven foreign ministers in Munich on Saturday. Russian President Vladimir Putin and Japanese Prime Minister Fumio Kishida will speak by phone later Thursday. Officials in Moscow have dismissed U.S. warnings of a possible invasion of Ukraine as “hysteria” and propaganda.

Key Developments

Ukraine, Russia-Backed Separatists Allege Cease-Fire Violations

Diplomatic Whirl Shows West Unconvinced by Russian Peacemaking

Where Military Forces Are Assembling Around Russia and Ukraine

Diplomats, IT Firms Flock to Habsburg Jewel on Kyiv War Worries

Equities took another hit on Thursday as concerns about tensions in Ukraine and economic growth offset a flurry of corporate earnings.

U.S. equity futures and Europe’s Stoxx 600 Index declined, while havens such as the yen and gold pushed higher. Government bond yields retreated and the dollar was steady.

China Tech Stocks Outlook Improves Year After $1.5 Trillion Rout

Some indicators suggest Chinese tech names are good to buy now

Tech rally started to fall apart in February 2021 on crackdown

“Just 12 months ago, a rally that pushed Hong Kong’s Hang Seng Tech Index to the highest level since a July 2020 inception started to unravel as traders raced to the exit over sky-high valuations and Beijing’s sweeping crackdown on private enterprise. “

Column: Global oil inventories are exceptionally tight

What could drive the Fed to a 'Plan B' for balance sheet reduction

Austin Says Russia Still Boosting Blood Supplies

Western allies are seeing Russian troops inch closer to Ukraine’s border, with more combat and support aircraft, and they’re also stocking up on blood supplies, U.S. Defense Secretary Lloyd Austin told reporters, following a meeting of NATO’s defense ministers in Brussels.

“You don’t do these things for no reason. You certainly don’t do them if you’re getting ready to pack up and go home,” Austin said, adding the U.S. and its allies would continue to remain vigilant for any attack. Western officials have raised doubts about Russia’s claims it is pulling back troops from Ukraine borders, while Moscow denies any intention to invade. —Bloomberg

U.S. Housing Starts Drop 4.1% in First Decline in Four Months

New construction falls 4.1%, suggesting impact from omicron

Rise in building permits, backlogs signals firmer construction

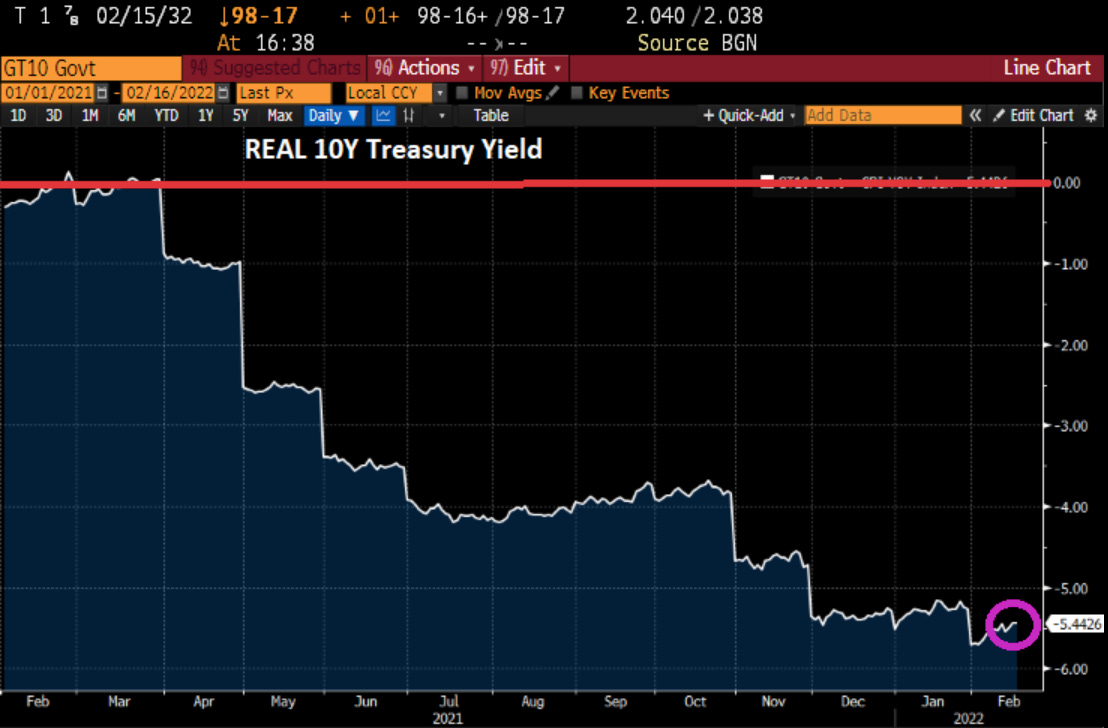

Real 10Y yield: -5.4426%?

I’ve been slowly adding back to US equities, about 1-2% a day, adding about 2% in small-cap value exposure and 3% to actively managed large value funds (I do not want to own the “top” of the value index). I’ll be waiting for more news to make sure it’s safe before adding more.

While I am holding a good amount of the S&P, which I’ll never touch, I’ll be looking to buy more $COWZ and $EFV, as well as $VEA for developed markets and $DFAE for emerging markets.

At 4PM yesterday, I took about 5% out of the US total market index, and added it to developed markets (ex-US). $VWICX and $VTRIX and $DODFX and $SFNNX have all done well on the mutual fund side. $IDV and $EFV for international value, and $COWZ for US value.

As I still need to finish my coffee, I’ll leave things here and catch up with you all soon. MMM COFFEE!

—Avery