Rally Falters, Russia Provokes

Rising rents, lower wages, binance, Airbnb, retail sales, crypto?

Good morning! My coffee came out perfectly, I hope you had a good night’s sleep. Here’s some things to start your day (that aren’t coffee, tea, alcohol, or whatever it is you’re getting up to).

I’ve got a lot of news to share!

Treasuries, gold steady; Italian bond yields at two-year high

Biden cautious on Ukraine as Russia says some troops withdrawn

AirBnb printing cash?

What the Binance.US Probe Says About the SEC’s Crypto Regulation Strategy

Russian stocks rose to the highest level in a week, volatility gauges for the S&P 500 and the Treasury market are sitting significantly above 12-month averages

U.S. Retail Sales Rise Most in 10 Months in Broad-Based Rebound

“U.S. retail sales rebounded by more than forecast with the biggest gain since March, as Americans kept spending through a Covid-19 spike and hot inflation to help drive the economic recovery.

The value of overall purchases rose 3.8% in January after a downwardly revised 2.5% drop in the prior month, Commerce Department figures showed Wednesday. The figures aren’t adjusted for inflation.”

NATO Secretary General Jens Stoltenberg says Russia appears to be continuing its military buildup. He’s speaking now:

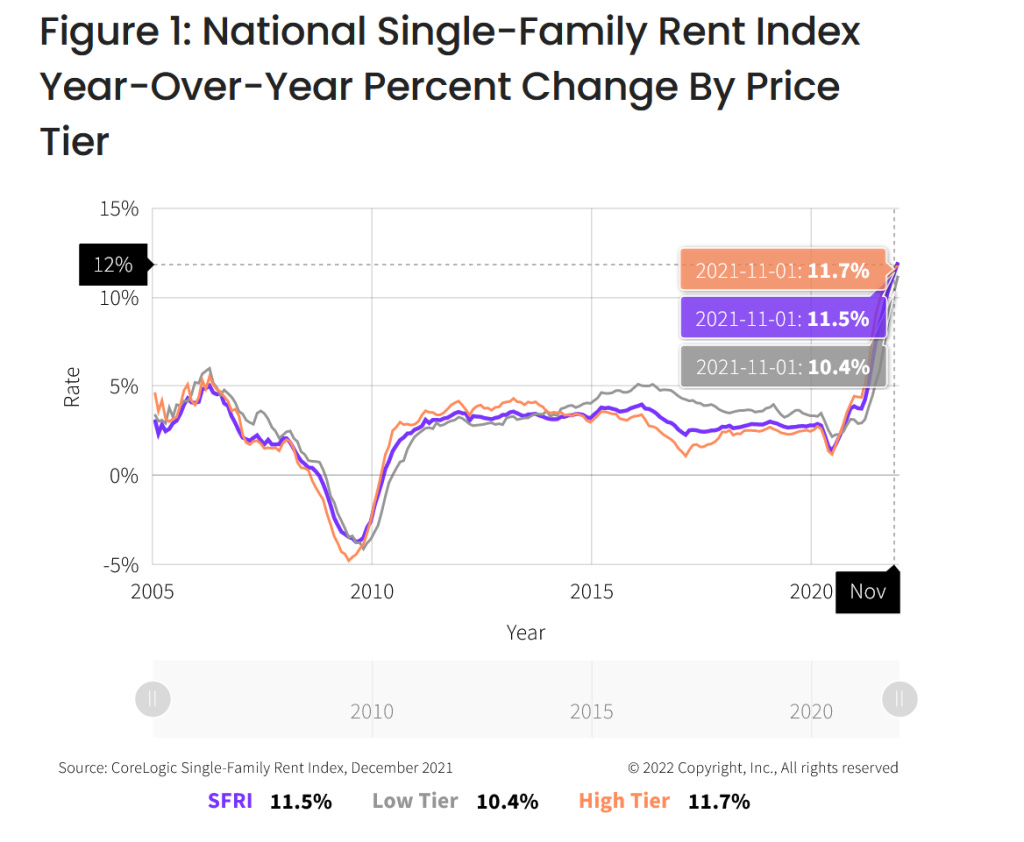

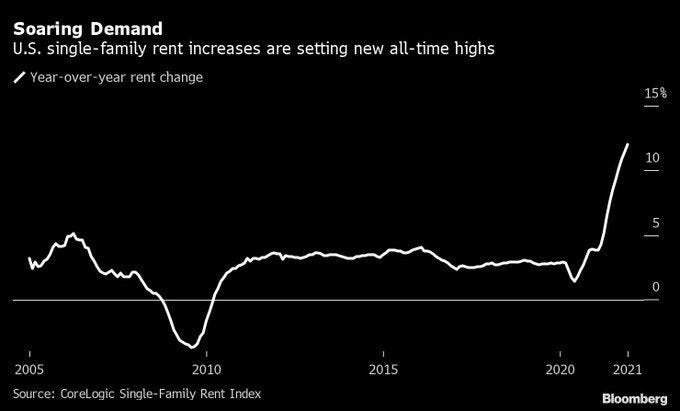

Rents are up, demand is up, the squeeze is on

Breaking down single-family rents from Corelogic, +11%

Single-family rents are setting records

+36% rents in Miami, $2373 median rent in November… that’s a lot. $3213 in San Diego. I don’t know who can afford this stuff.

It’s not just the US: “UK house prices rise almost 11% in 2021 to new record” —FT

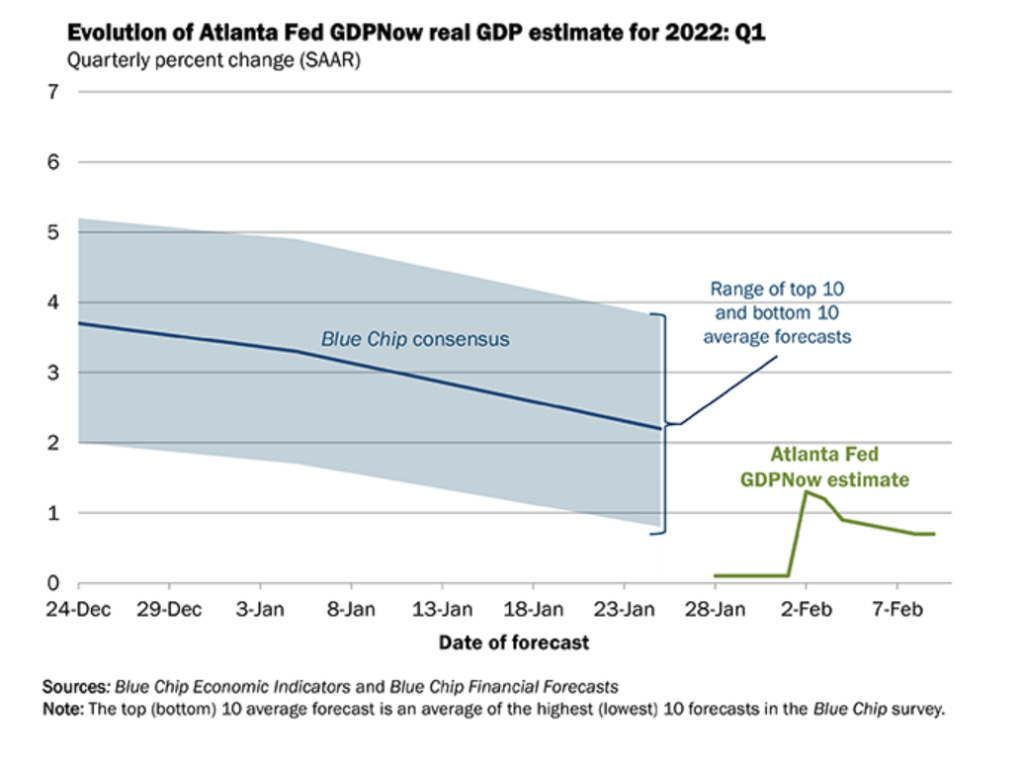

While I’ve got it, GDP estimates are interesting, but massive government debt could hit GDP by an equivalent of 3-4%. I worry about the whole government shutdown-showdown thing happening again. We really need to see rising GDP.

I wouldn’t bet on it though, without immigration, the US is going into a death spiral and is trying its hardest to look like Japan, in more ways than one.

What the Binance.US Probe Says About the SEC’s Crypto Regulation Strategy

Crypto companies are keeping the Securities and Exchange Commission (SEC) busy this week. The SEC’s settlement with BlockFi, a cryptocurrency lender, to resolve the agency’s allegations that the company’s investment products were illegal. As of Tuesday, the SEC had a new target in Binance.US, the American division of the world’s largest cryptocurrency exchange. The agency is looking into the company’s alleged ties to two large trading parties that use its platform, according to a report from The Wall Street Journal.

The context of both SEC probes is different. With BlockFi, regulators were concerned about the legality of a particular product, and with Binance.US, they are worried that the exchange may be giving certain trading partners preferential treatment. But regardless of the surface differences, the probes are likely advancing the SEC’s broader goal: to show that crypto assets and tokens are, in fact, securities, and that they should be regulated as such.

But if the SEC wants to show that tokens are securities, why not first prove that, and then take these companies to task for not registering with the agency?

That said, spending time and resources to prove that tokens themselves are securities may not be the most efficient path forward. If the SEC can show that the crypto industry adversely affects investors, that in itself may present enough evidence to impose regulation.

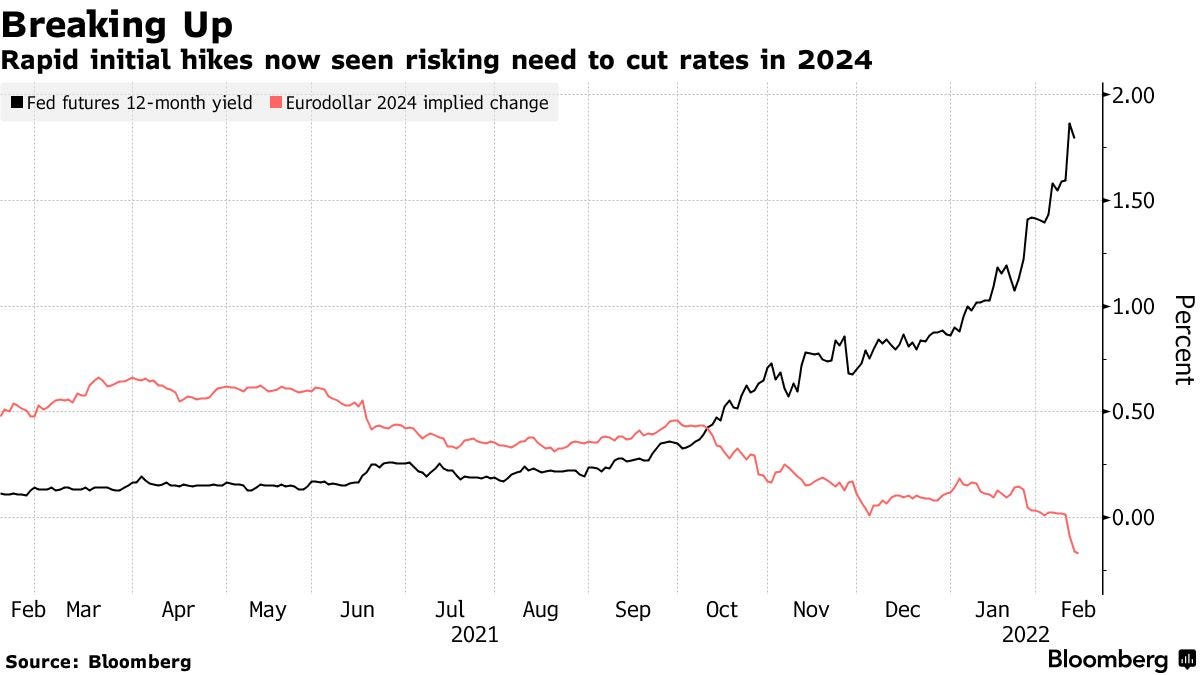

Rally Falters as Russia, Inflation Risks Return

“Geopolitical tensions should not mask the fact that rates are in an uptrend,” ING Bank NV analysts led by Padhraic Garvey wrote in a note to investors. “This is a global trend if there ever was one.”

U.S. President Joe Biden said it’s still possible that Russia will invade Ukraine because its troops remain in a “threatening position,” while North Atlantic Treaty Organization Secretary General Jens Stoltenberg told reporters in Brussels that Russia is continuing its military build up.

Moscow has repeatedly denied it plans to invade its neighboring country.

In other news… Xi’s not done in HK

From the FT: China’s president Xi Jinping has told Hong Kong to “take all necessary steps” to contain the city’s biggest coronavirus wave, sparking fears of more stringent measures as patients are left lying on beds outside hospitals in the Asian financial hub.

Xi’s intervention came just days after Hong Kong officials met their mainland counterparts (you can click that) over the weekend to devise plans to achieve zero-Covid in the territory.

Ericsson says it may have paid Isis terror group in Iraq

Shares in Ericsson fell sharply after Borje Ekholm, chief executive of the Swedish telecoms equipment maker, conceded it could have made payments to terror organisation Isis in Iraq.

Nice one, Ericsson.

Kraft Heinz beats estimates as price rises pays off

Kraft Heinz beat expectations for the fourth quarter as price increases offset inflationary pressures on costs.

The company, known for products such as Heinz Ketchup and Kraft macaroni and cheese, reported net sales of $6.7bn in the fourth quarter, a 3.3 per cent decline from the year earlier, but better than Wall Street’s estimates of $6.6bn in revenues.

TI: KKR Shows Private Equity’s Crypto Cravings; Dune Analytics Opens Window on Blockchain Data

“Private equity has its sights set on crypto. The latest: KKR is considering an investment in Animoca Brands, a Hong Kong-based gaming company building metaverse products with blockchain, according to a Bloomberg report. The investment is said to value the company at over $5 billion.

Private equity firms are the latest to join the crypto craze. These firms previously invested in venture funds focused on blockchain. For instance, last September KKR made its first blockchain investment when it invested in the crypto-focused ParaFi Capital’s fund.

Now, we’re seeing PE firms make direct investments. It was only a matter of time: the past few years’ growth means that startups are bigger and on the hunt for the larger checks that PE firms can write. After starting out with investments in firms like crypto custodians that are more similar to traditional financial institutions, PE firms are now starting to branch out.”

Startup to Watch:

Dune Analytics

Founded In: Oslo, Norway

Total Funds Raised: $79.4 million

Valuation: $1 billion

Investors: Coatue Management, Union Square Ventures, Dragonfly Capital Partners, Multicoin Capital

What Sets It Apart: In February 2020, Fredrik Haga and his partner Mats Olsen traveled to San Francisco from Norway hoping to raise capital for their blockchain analytics company. They were unsuccessful at raising a $1 million seed round, but only two years later, the company is now valued at $1 billion.

Dune Analytics operates an online platform that allows users to analyze blockchain transaction data. Analysts on the platform, which it calls “wizards,” use Dune to create dashboards with real-time data about user activity related to non-fungible tokens (NFTs), decentralized exchanges, cryptocurrency wallets, and other applications based on Ethereum, a dominant blockchain network that supports finance applications. Analysts can use Dune for free as long as they post the output of their analyses online for public use.

“We’re really embracing the openness of blockchain data and making it a practical reality,” said Haga in an interview with The Information.

Dune’s present business model features a $390 per month premium subscription if users want to export their analyses for private use. But Haga said the company is much more focused right now on making Dune compatible with blockchains other than Ethereum.

The value lies in the community the company has built. Some 10,000 wizards have developed 100,000 analyses since Dune was founded in 2018, with most of its growth coming in the past year. The number of analysts on the platform increased by 50% from December to January, the company says.

That growth is presumably what drew Coatue Management, a hedge fund that operates a large private tech fund, to Dune. Coatue led the company’s latest $69.4 million financing at a $1 billion valuation. (Coatue managing partner Kris Fredrickson, who left the venture firm in late December, led the round, according to Dune.)

Coatue was quick to make a decision about investing in Dune without the startup providing much information, said Haga. “We didn’t make a single slide or excel sheet,” he said.

One of Dune’s goals is to make the finances of companies built on the blockchain much more transparent. For example, one wizard on Dune has created a dashboard showing the real-time income statement of MakerDAO, a blockchain lending organization. Haga contrasts that with the slow pace at which public companies currently post financial statements. In January, the company published a blog post that summed up its ambition: “The Revolution Will Not Be Reported Quarterly.”

Salesforce Targets NFTs

Salesforce plans to launch a cloud platform for NFTs, CNBC reported. The service, which co-CEOs Marc Benioff and Bret Taylor discussed at a sales event Wednesday, will allow artists to create NFTs. The platform will also allow them to list NFTs on a marketplace similar to OpenSea, currently the dominant venue for buying and selling NFTs.

A spokesperson for Salesforce declined to comment on the report. The cloud services company has previously expanded beyond its core offering into social media and even streaming services meant to compete with Discovery, Paramount and other media companies.

Deals:

Streetbeat, a startup developing an app to invest in stocks and cryptocurrencies, raised $10 million in a seed funding round led by TTV Capital.

OpenNode, a payments platform that allows merchants to accept bitcoin, raised $20 million in a Series A funding round led by Kingsway Capital that valued the company at $220 million. Twitter also participated in the round.

Compute North, an infrastructure company focused on bitcoin mining, raised $85 million in a Series C round led by Mercuria and Generate Capital. The company also raised $300 million in debt financing.

Some More Reading

Maybe There’s a Use for Crypto After All

Helium, a wireless network powered by cryptocurrency, hints at the practical promise of decentralized services. —NYT “THE SHIFT”

Russia to Regulate Crypto, Dispelling Fears of Ban

“Instead of banning cryptocurrencies, the Russian government has decided to regulate them, legitimizing a $2 trillion asset class in the world’s 11th-largest economy.

A document setting the principles for the regulation of cryptocurrencies appeared on the government’s official website on Tuesday night. Notably, the plan has the support of the central bank, which had called for a ban on crypto mining and trading.”

Tiger’s Fund Flex; Bored Apes Funding Goes Bananas

“The New York-based hedge fund has so far raised more than $11 billion for its latest venture capital fund, which is expected to close in March with a total of $12 billion.

Tiger’s ability to push past the original target for its new venture fund—last year the plan was to raise $10 billion—means it will have a lot more dry powder to invest in crypto.” —The Information

PayPal Can’t Depend on Crypto to Rejuvenate Earnings

“Big tech companies may be investing in blockchain. But sometimes they ought to focus on their core business.

PayPal is one example. On Wednesday, shares of the payment giant sank nearly 25% after the company issued a lackluster earnings forecast for 2022 and axed earlier customer growth targets. The company launched a feature to buy, sell and hold bitcoin last year, and it confirmed last month it was looking into launching its own stablecoin, a type of digital asset backed by a traditional currency like the U.S. dollar. But some back-of-the-envelope math reveals how little those efforts are likely to help financial performance over the coming years.” —The Information

Wishing you a lovely Wednesday. Thanks for reading!

—Avery

Edit/Postscript:

P.S. After a wild month of trading and repositioning throughout January, I’ve resolved to keep at least 95% of my investments in ETFs and mutual funds. Check my post from yesterday for some ideas. I think that portfolio construction is going to be a big differentiator going forward, and that merely holding one index fund isn’t going to cut it. Picking stocks is likely to get people slaughtered, and I’ve really begun to worry about folks who are trying to find individual stocks.

I pick stocks for a living. I’m quite good at it. But our payroll is quite high; I have a lot of help and resources. At home, I don’t like picking stocks very much. I want to relax and live my life. Trading can be fun, exciting, and occupy your time, but there’s always something more interesting/fun to do with your time.

Besides, it’s far easier to save a few % a year than to generate a few % in returns. My suggestion is to lock into a portfolio you’re comfortable with and, instead of trading it, work on fine-tuning it. I’ll make sure you’re not alone.

If you haven’t already, try to get your assets to a good brokerage. Fidelity has some advantages, but Vanguard is “the destination”, and where I’ll want my assets when I retire. What if someone buys Fidelity, or they close up shop? What if they jack up fees? What if Schwab gets caught in an awful scandal? How do I know these guys aren’t letting hedge fund engage in late trading of mutual fund shares?

I’ll never know. All I know is that I am one of the owners of Vanguard, as it’s the only mutually owned company that’s got mutual funds. I’ve been re-reading “Common Sense on Mutual Funds” by John Bogle. Helps bring me down to earth after a particularly good month (relatively speaking…).

I prefer the Audible version.

That's a lot of information. Nice work. GDP is decelerating. Fed is going to tighten into it. Blunt tools, blunt results.