Update (2:51pm ET): Western Allies See Kyiv Falling Within Hours: Ukraine Update

Western allies see Kyiv, the Ukraine capital, poised to fall within hours to Russian forces. U.S. President Joe Biden announced additional sanctions on Russia as Western countries grappled with how to respond. That’s as fighting continued in Ukraine with Russian troops attacking from the north, south and east. —Bloomberg, 2:51p ET

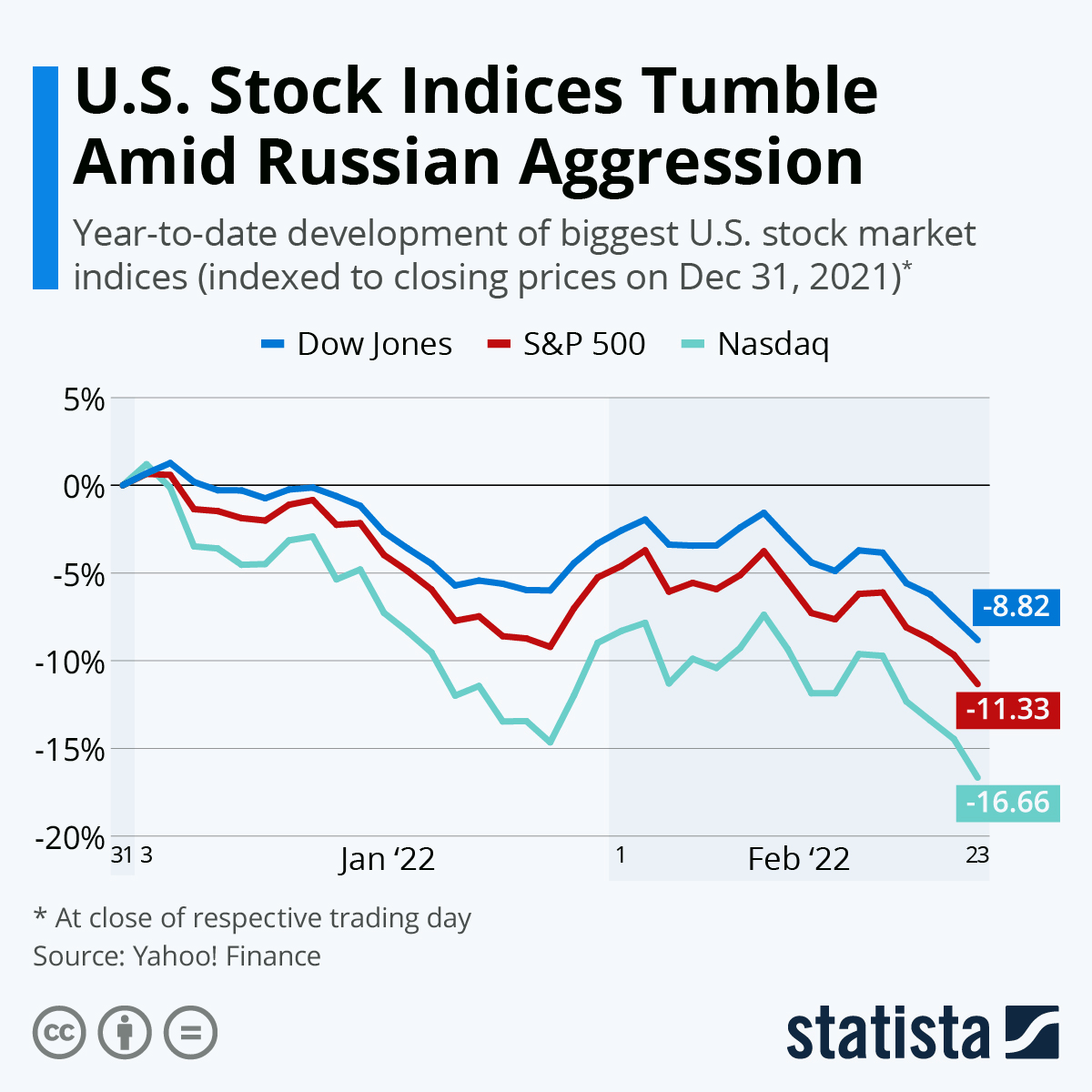

US Stocks Tumble Amid Russian Aggression

Russia Invades Ukraine, NATO Pledges Sanctions

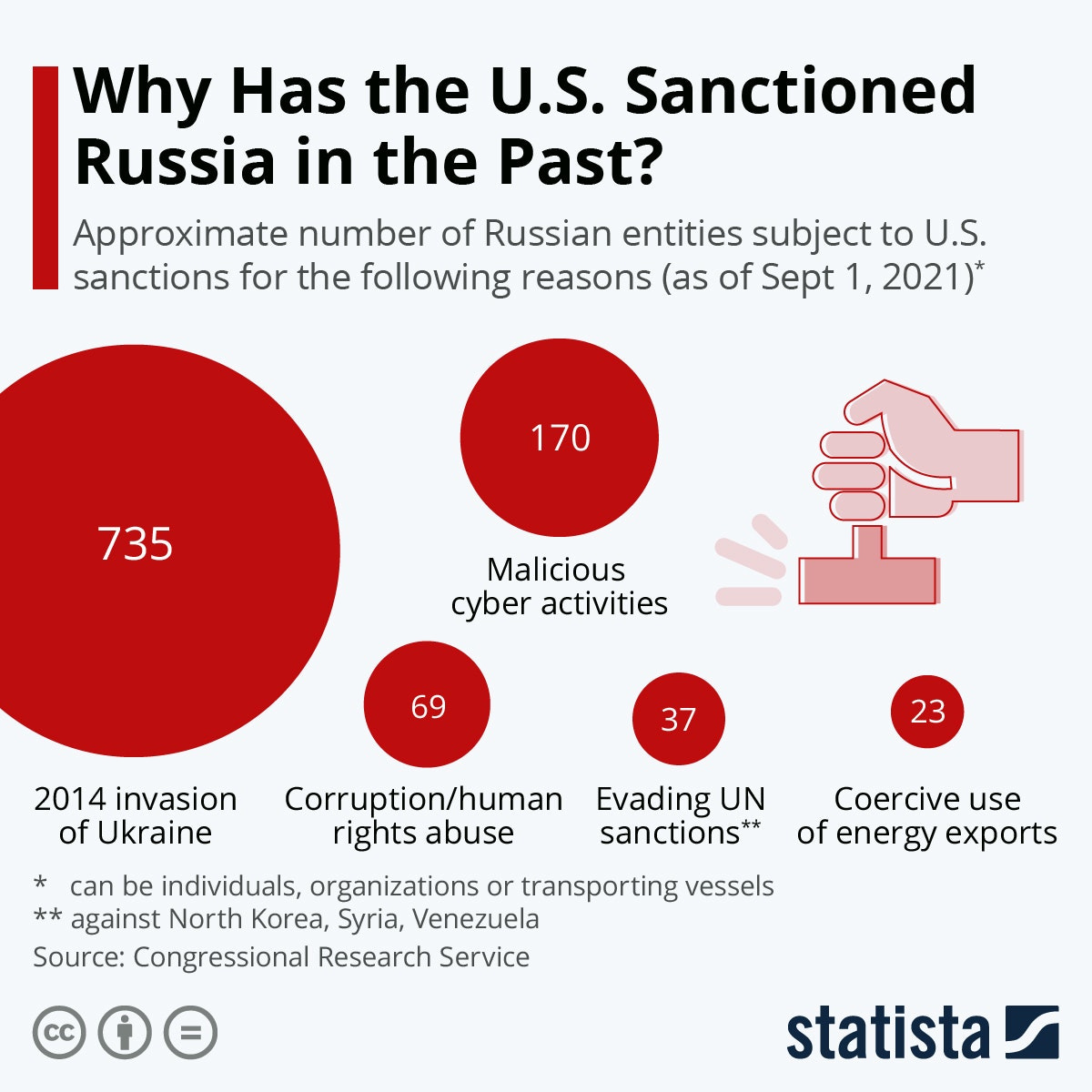

Action on the ground is developing quickly, and the Russian invasion has shocked markets. What does it mean for the global economy? What kind of impact can we expect from an expansionist Russia and heavy American/European sanctions?

With no pending military action between Russian and NATO forces, and no serious interruptions to commodities coming from Russia, what can we expect?

Markets in Shock

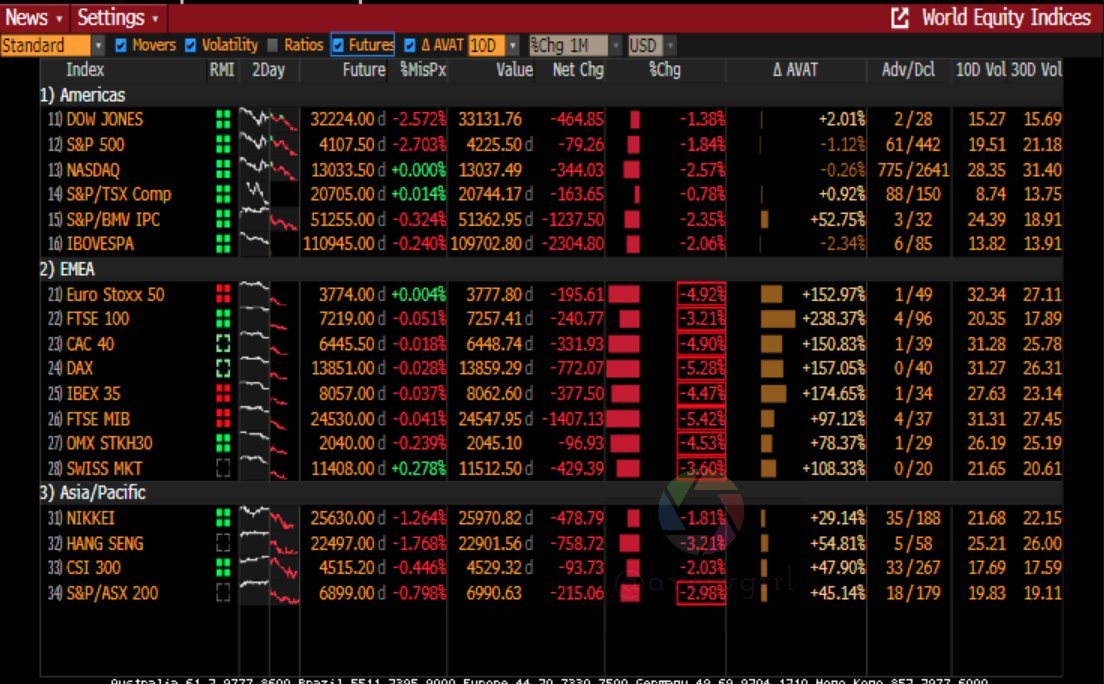

As of 12:50 PM ET on Thursday, the blow to equities hasn’t been too dramatic, with the MOEX/MICEX dropping precipitously, and other markets dropping into correction territory. While a sharp rise in oil prices is certainly something to take account of, the move has been significant, but not tremendous. Prices for natural gas in Europe have surged dramatically, however, which should add additional pressure on EUZ economies.

Beyond commodities, Russia is merely a bit player in global capital markets. This is in stark contrast with China, which holds an outsize role in supply chains worldwide. Countries in Central and Eastern Europe only send 2.5-3% of their exports to Russia. For the US, that link is even smaller. Savita Subramanian (BofA Managing Director), has pointed out that only 0.1% of S&P 500 sales are attributable to Russian ties.

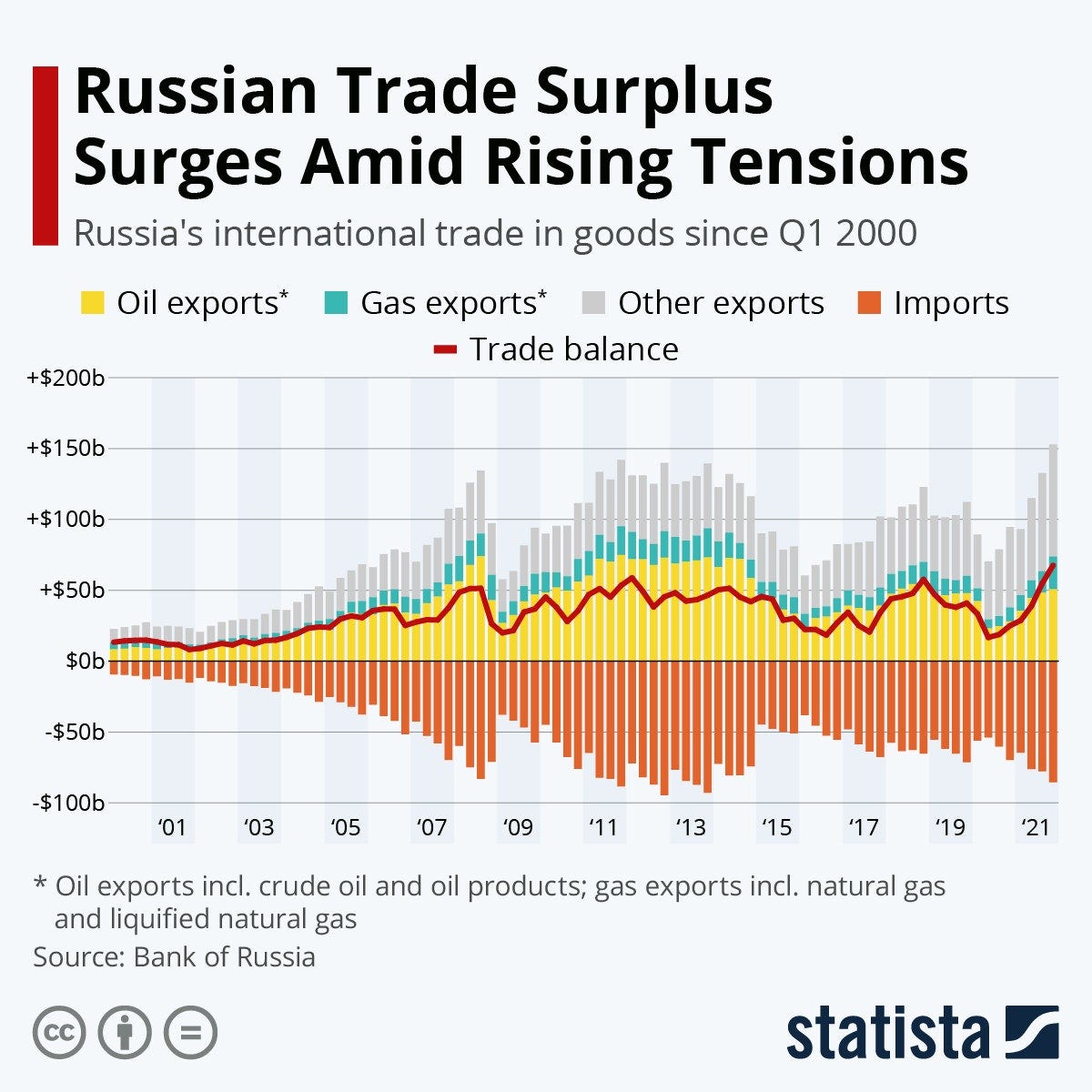

Energy and Economic Growth

The US and global economy have strong momentum heading into the invasion, and growth should be well-above-trend (3.6% compared to 1.7% trend) in the US, the Euro Area (3.5% vs. 1%) as well as worldwide growth (4.25% vs. 3-3.5% trend).

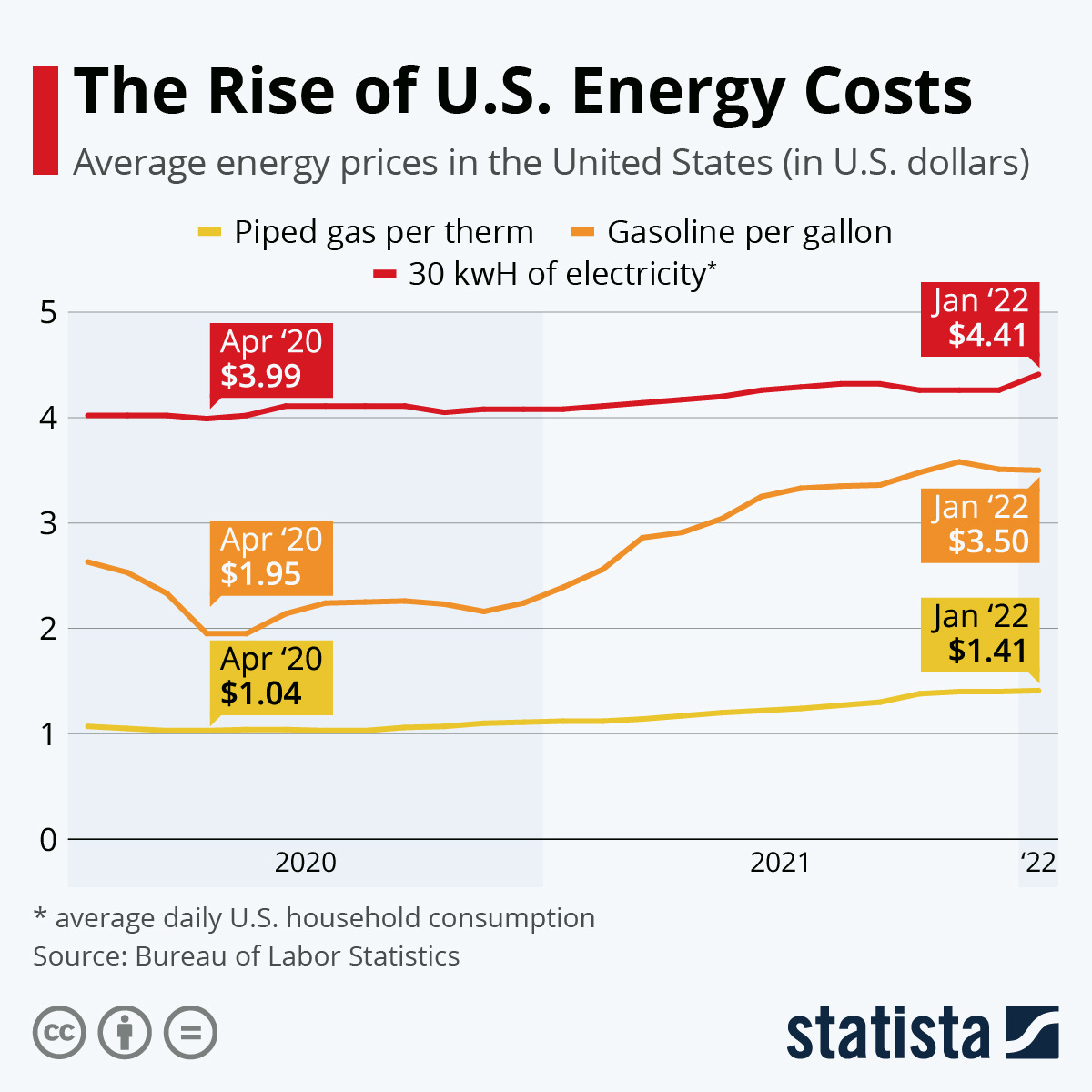

The European economy has much higher exposure than the US, which is exacerbated by the potential threat to natural gas supplies. The EU receives approximately 32% of its natural gas from Russian sources, with the UK receiving about 5%. Some countries, such as Moldova, receive nearly 100% of their natural gas supplies from Russia.

The US, on the other hand, is energy-independent. This means that rising energy costs can be viewed as a swap, as rising costs are overlooked by producers and simply passed on to American consumers. After subsidies, this is merely a transfer of income from energy consumer to suppliers, which should have a negligible/muted net effect on the economy. A $10/bbl increase in oil prices (along with similar increases in other energy prices) can be expected to attenuate US growth by 10% the following year.

Market Reaction

Popular Asian equity indices ended the night negative, with the SENSEX (India) off -4.7%, the HSI (Hong Kong) down -3.2%, and the KOSPI (Korea) off -2.6%. The N225 (Nikkei 225, Japan) shed -1.8%, while the Shanghai Composite dropped -1.7%. Pacific equities are off -2.37% and Emerging Market equities are down -4.1% in USD.

Aggregate European stocks are down approximately -4.07% (USD). The S&P 500 was down -2.2%, but has since recovered, led by growth stocks, and is only down -1% at the time of writing as investors readjusts their rate hike expectations.

The dollar has strengthened, with the DXY up nearly 1%. WTI crude was up $7.50 to $99.60/barrel as of this morning. Spot gold rose to $1962.06, with Corn and Wheat up over 5% each.

EMEA 10y bonds were somewhat mixed, with notable moves in Ukrainian 10y yielding 21.3% and Russian 10y yielding 15.23%, up 1337.5 and 671 over the past 3 months. This is quite a significant move for the countries involved, but didn’t have tremendous impact outside of Turkey and Romania, with Polish yields moving up only slightly (less than expected).

Covid-19 Cases

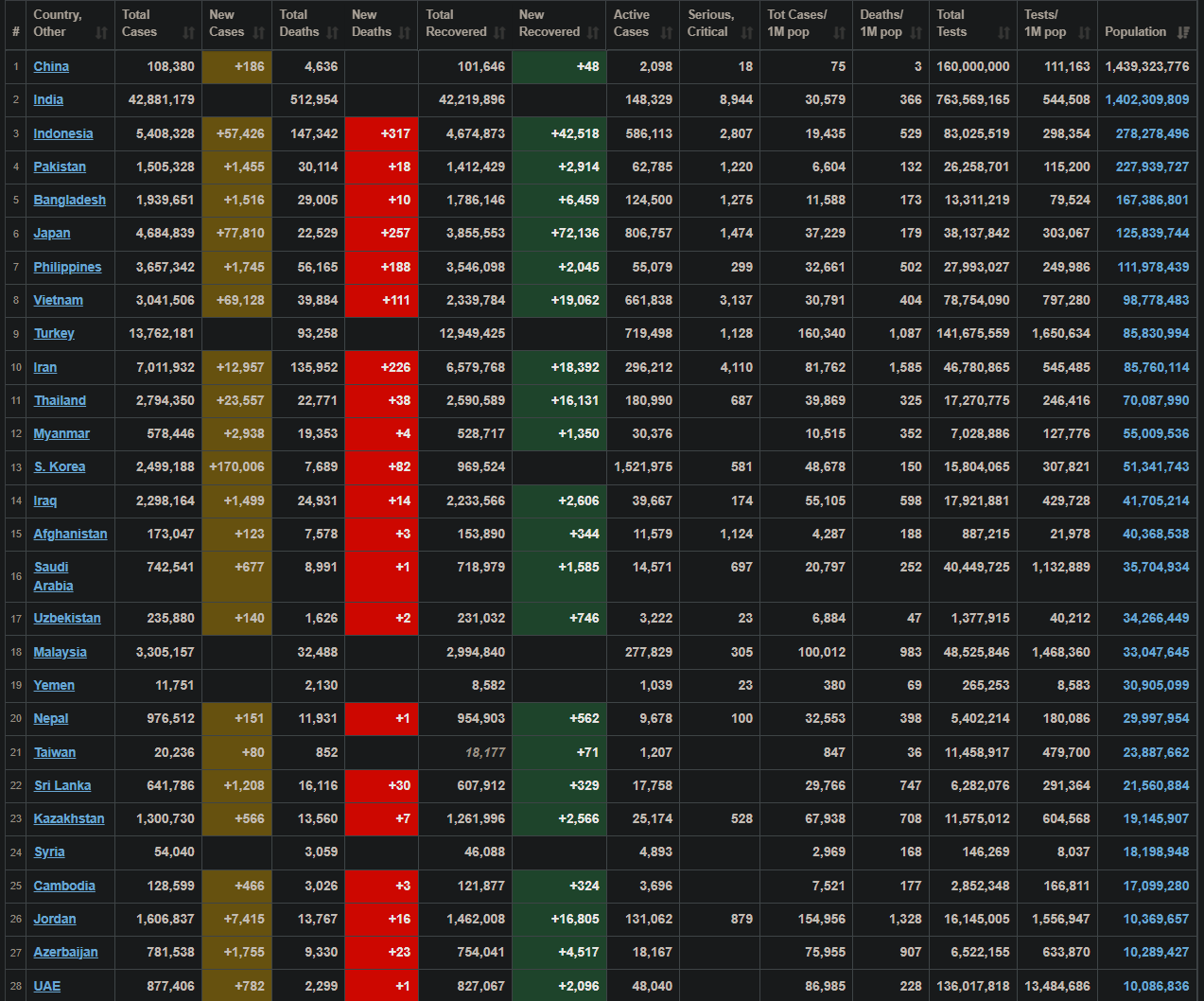

A sharp decline in the number of Americans testing positive for CV19, as well as a general decline in global numbers has US cases down -90% and E-5 cases down -60% from their respective January peaks.

That said, cases are rising rapidly in Southeast Asia (which includes major manufacturing hubs such as Vietnam and Malaysia; Apple has diversified their supply chain by moving some manufacturing to Vietnam, for example). As such, there should be some knock-on effects for the nations they supply. Daily cases in the region have tripled over the past month and reached new peaks.

Economic Releases

Initial jobless claims for Feb 19 came in at 232k vs 235k forecasted and 249k previously. Continuing claims were at 1.48m for the Feb 12 reporting period vs. 1.59m previously. GDP (SAAR) for Q4 hit the mark at 7%, as expected, up from 6.9%. Final sales revision (SAAR) came to 2%, up from 1.9%.

The Chicago Fed national activity index for January was 0.69 after falling to 0.07 in December. January saw 801,000 in home sales (803k expected), vs. 839k previously.

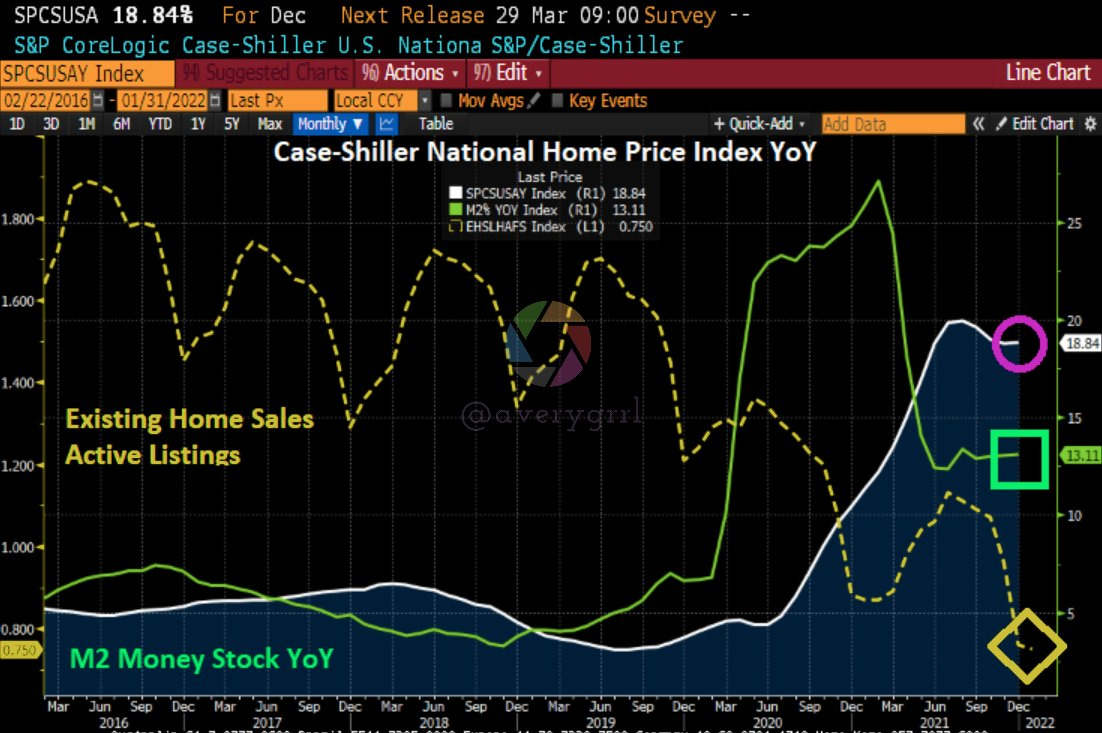

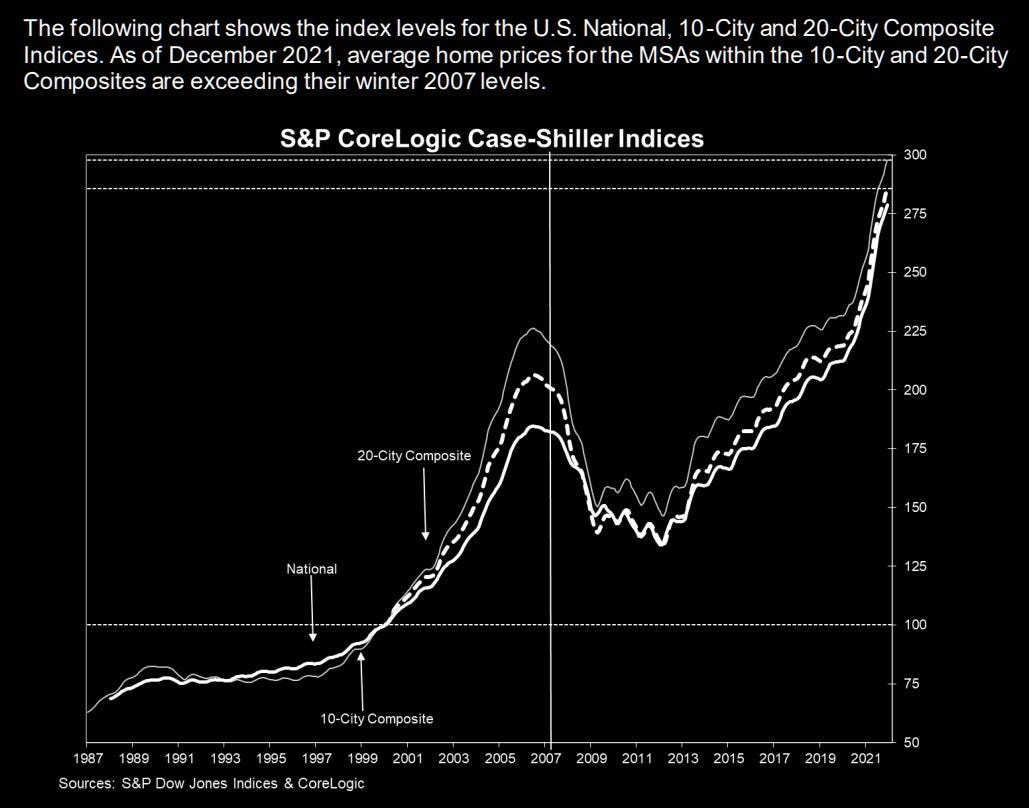

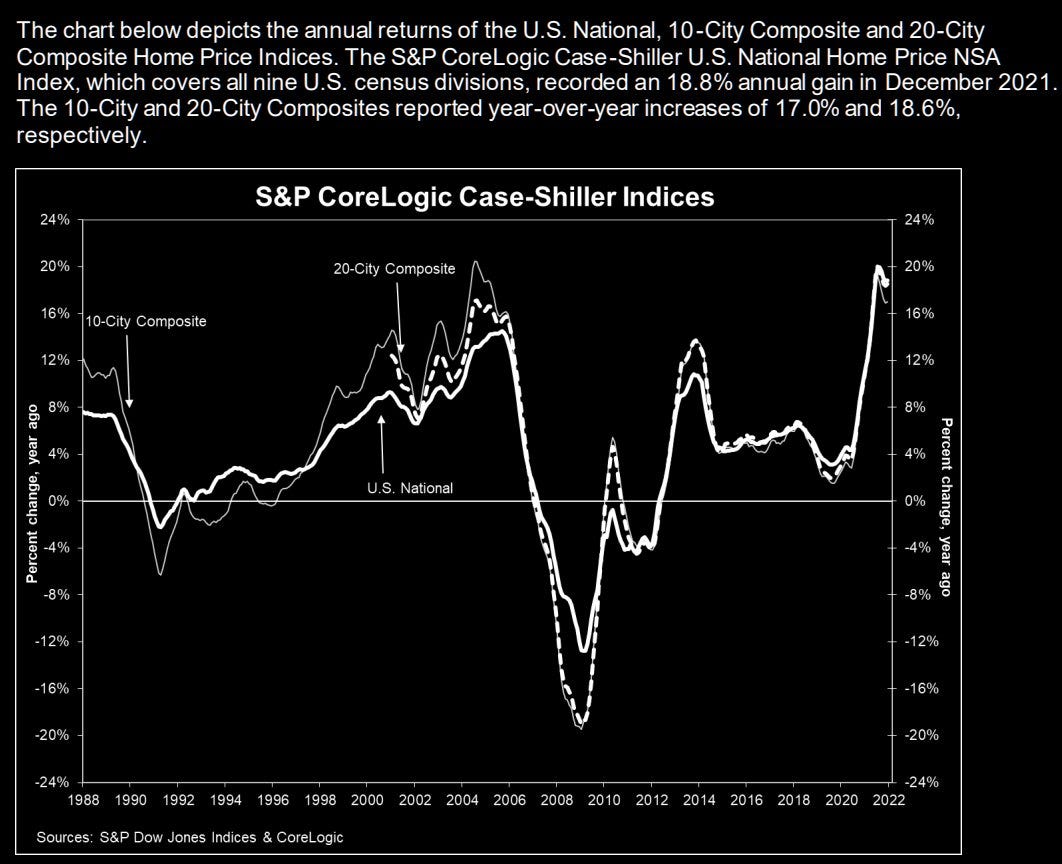

On Tuesday, we saw the S&P Case-Shiller HPI up 18.8% YoY, FHFA HPI up 17.6%, Markit manufacturing PMI (flash) hit 57.5 vs. 56 expected, up from 55.5 in January. Markin services PMI (flash) rose to 56.7 vs. an expected 52.2, up from 51.2. Consumer confidence is back to 110.5 (109.5 expected), down from 111.1 previously.

Things are getting pretty expensive, despite listings dropping to their lowest mark in many years. If we overlay M2 YoY, we can see that M2 was transitory, but inflation appears sticky.,

The S&P CoreLogic release was pretty mind-blowing, and it’s starting to look like housing is priced for perfection. These kind of parabolic moves in HPIs (housing price indices) presaged the GFC.

Annual returns for the 10 and 20-city CHP indices are the highest I’ve seen since the GFC (20-city only dates back to 2000, but peaked just below the current rate).

Rates: What Now?

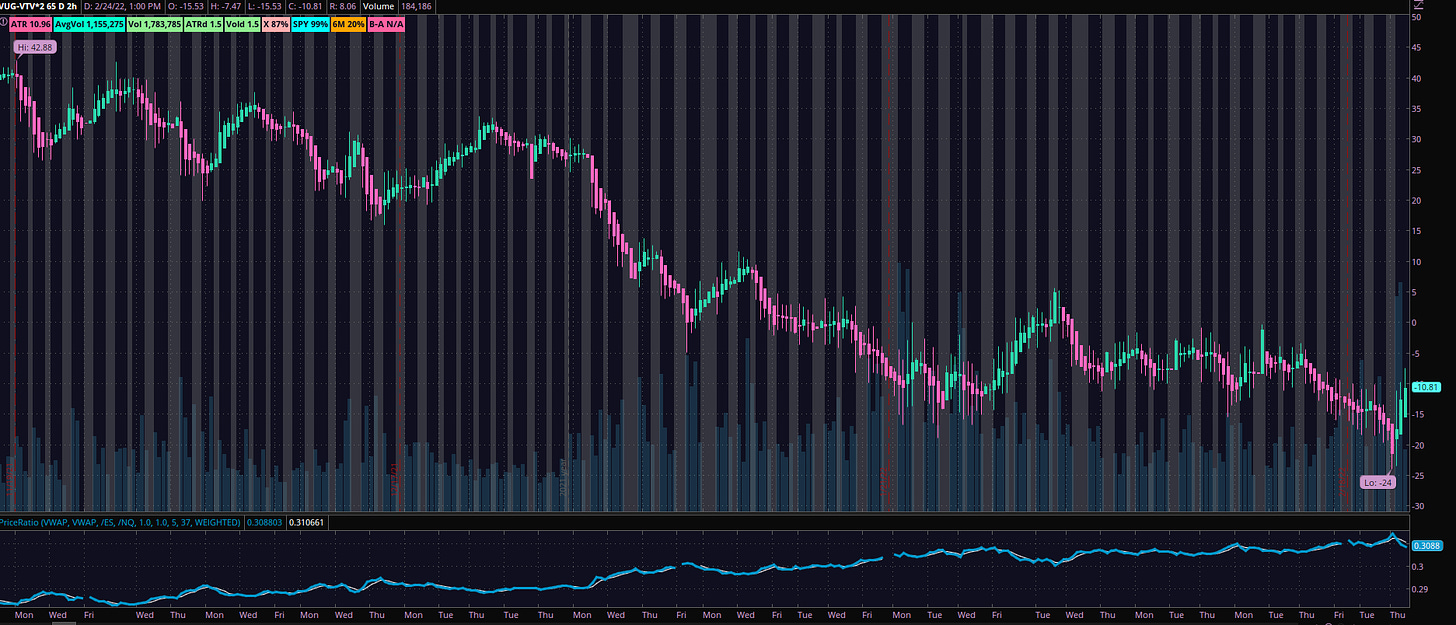

Growth has had an awful run. The upper chart shows VUG - VTV*2, charting the strength of the growth factor. The subchart is the S&P vs. Nasdaq price ratio, with the S&P gaining rapidly on the Nasdaq, quite in-line with VUG/VTV.

This is where things get tricky. I always advocate for value investing over the long-run, but I expect we could see a small recovery for growth stocks. In fact, today we saw one of the only instances of value being sold for growth in 2022. This would indicate, to me at least, that sentiment for growth stocks has improved. For those that missed the rotation to value, there may be some much-welcomed respite in today’s price action.

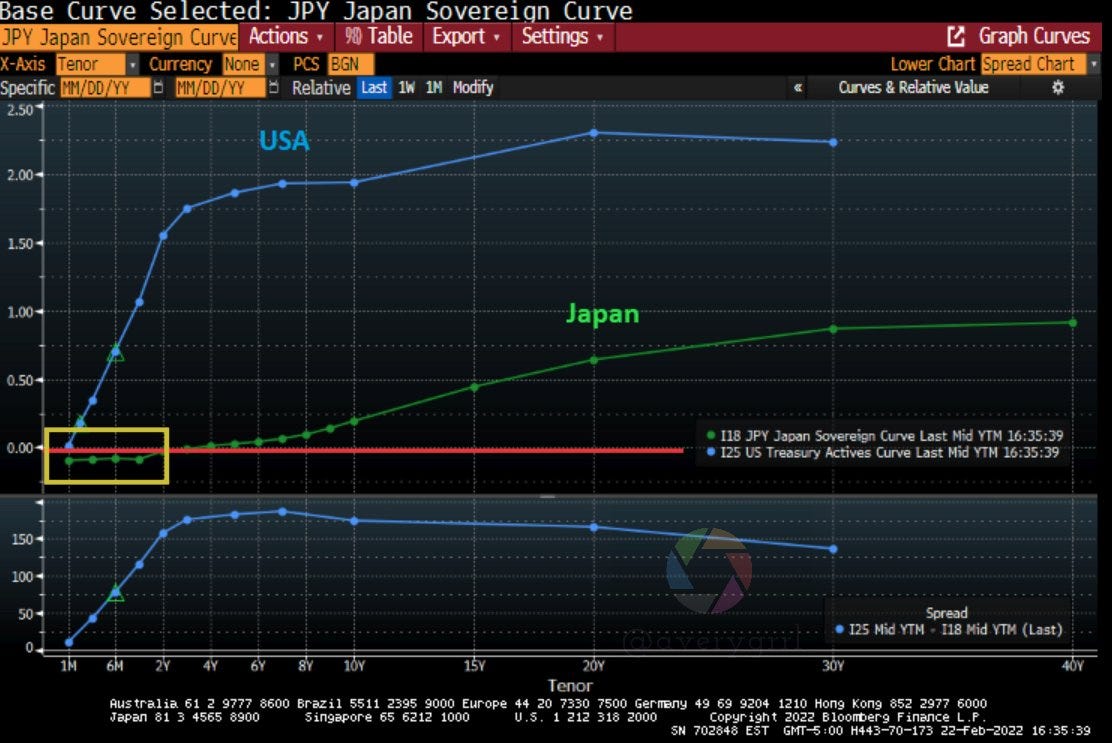

US vs. Japanese yield curves: Japan YCC in full effect while US rates have lifted off.

Bear in mind that with so many moving geopolitical “parts”, that the picture could change rapidly. EAFE Value stocks have had one of their worst days in recent memory, with $EFV down -4.15% on the day, an ETF that has held up remarkably well during 2022’s drawdown. Europe has led DM equity declines, but I suspect that this is an overreaction, and would recommend holding onto EAFE value exposure if you have it, and allowing the market to digest the current events.

There’s nothing wrong with holding vanilla indices like the S&P 500 or international stock, although 2022 has been a brutal year for growth. Today, we’re seeing a bit of a relief rally.

Global Risks in 2022 (WEC Risk Report)

In case you missed it, I found this visual timeline of Global Risks from the WEC Global Risks Report particularly interesting.

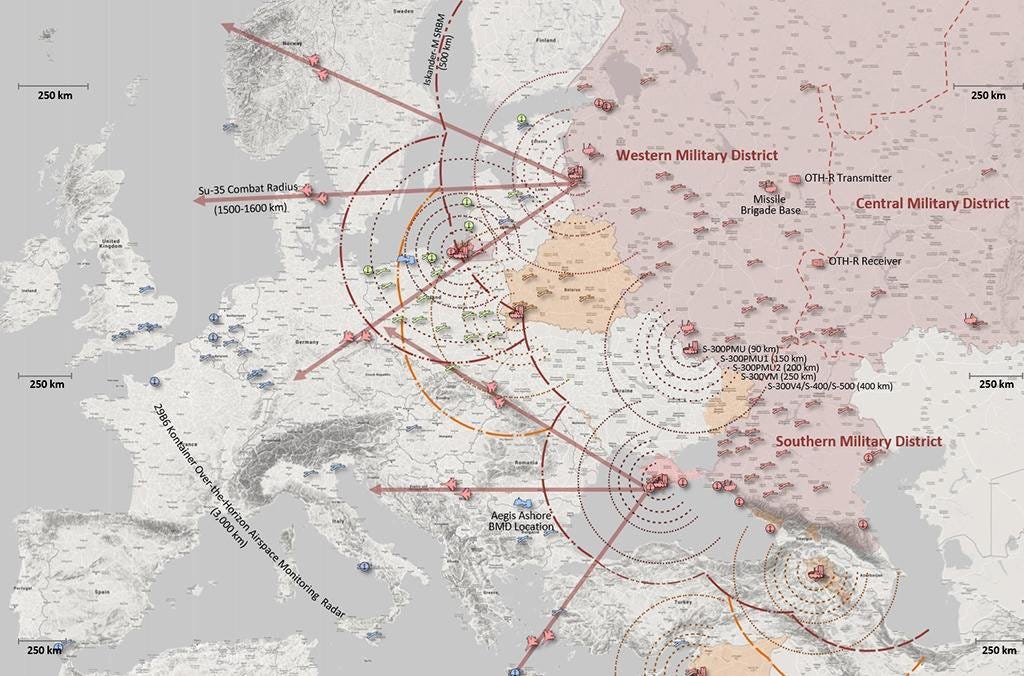

A Visual Guide to the Russia-Ukraine Conflict

Yesterday, I tweeted out a handy visual guide to the conflict in Ukraine. I love visuals, and they certainly help me retain/learn new information more effectively.

Twitter thread here:

I’ll quickly cover a few of the images while you’re here.

Russian troop positioning:

Russian troop build-up (Feb 22)

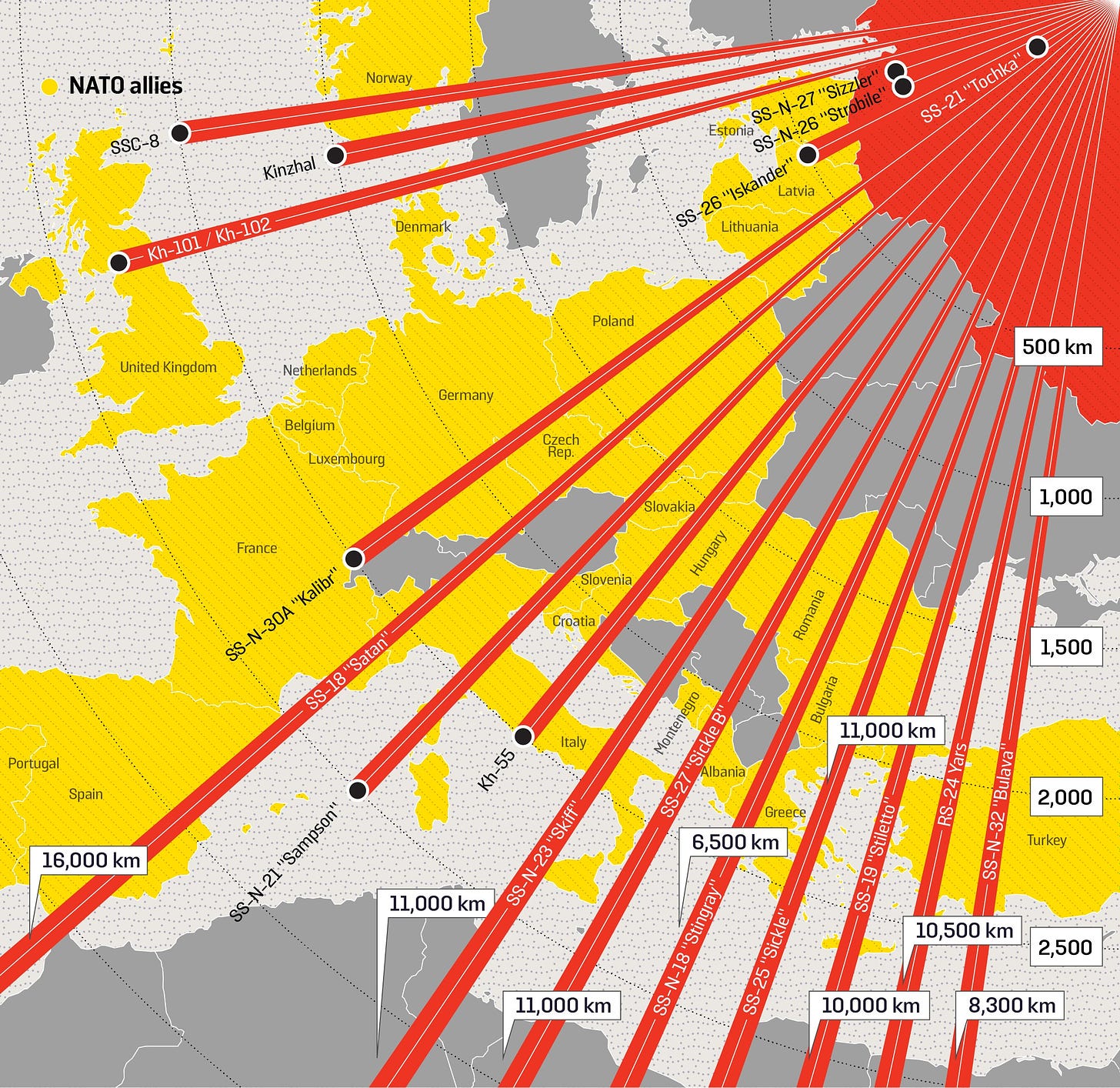

Range of Russian land-based missiles, overlaid with NATO in yellow.

Russian military districts, combat radii, and strategic assets:

Missile defenses:

I’m wishing you all good luck navigating these fraught markets. While it’s difficult to stomach, I am remaining 100% invested now, and have repatriated some assets away from EM nations and Russia in particular. I’ll be giving EAFE Value some room to breathe, but have plans to slowly add back more US exposure, including the S&P 500. I do not plan on investing in any growth indices, as the S&P 500 is pretty growthy and difficult to balance. (I like to use $VWICX for my international holdings, as the slight value/energy/financials tilt works well with the S&P 500 and cap-weighted US indices in general). If you’d like to learn about $VWICX, I wrote about it in another issue, linked below.

Moving Forward

Be careful in the coming days. Try not to trade too much, if at all. Be VERY patient as news develops, and try not to overreact. Take advantage of the market when it’s “weak”. This is what I call a “buyer’s market”. I have a weekly contribution to my IRA/401k, and raise it slightly whenever the market seems to be getting more affordable. The more shares I have, the more they’ll be worth when it’s time to retire. That’s some pretty simple math!

It’s not so much what happens to the value of your portfolio while you’re accumulating, but about accumulating as many shares to increase the value of your portfolio as much as possible when you can no longer accumulate shares. As long as you have a job, then you can save and accumulate shares.

I know that it may feel like you’re losing money (or if you’re sitting in cash, maybe you feel like you’ve outsmarted the market… if so, get back in there!), but that’s completely normal. 10%+ drawdowns/corrections are a routine and regular part of a healthy market, and gives us the opportunity to acquire more shares than we otherwise would.

Optimism is incredibly important. I even wrote a (kinda boring) piece about it, in case you missed it.

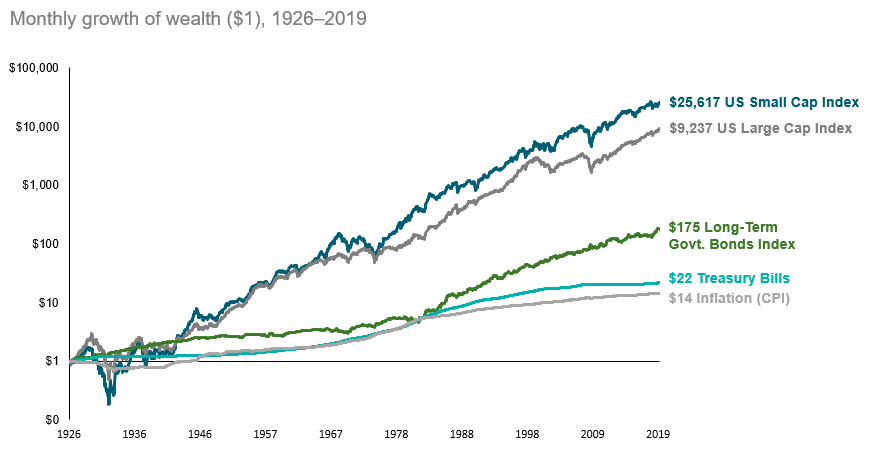

The Long Run

In the long run, drawdowns increase returns in two ways. First, expected forward returns necessarily increase as price decreases. Secondly, you’re able to buy more for less. A popular method for tracking holdings that doesn’t involve licking your wounds over short-term losses is something I call “accumulating shares”.

Instead of counting the dollar-value of investments, I prefer to count how many *shares* I own. Whether it’s mutual fund shares or ETF shares, it doesn’t matter. Each will be worth a certain amount in a few decades, and 2022 should fade until it’s merely a blip in the rear-view mirror.

Bonds have never returned much at all. The lower risk, the lower our returns. The more compensated risk we can take on, the more we can raise our returns.

I strongly encourage all of my clients to know their risk appetite, and to take on as much risk as they are comfortable with. Until yields surpass 7-8%, only equities will deliver the requisite returns to both beat inflation and create spending power later in life for you to draw upon. During every 30-year rolling period in history, equities have delivered higher returns than inflation, while bonds have not.

When you’re approaching retirement, by all means, consult a fee-only advisor (ensure they are a fiduciary) and decide on an allocation to fixed income. Sequencing risk, or the risk of retiring during a severe drawdown, is worthy of serious consideration and planning. This blog is written primarily with investors aged 18-55 in mind, but I didn’t forget about you if you’re over 55!

So Much To Learn, So Much To Say

If you haven’t heard of it, Paul Merriman has an “ultimate buy and hold portfolio” that he promotes. While I don’t advocate this type of portfolio, he has many different variations, and one may be suitable for you. I listened to his past 3 podcast episodes, and found them to be quite interesting.

You’ll find a link below to his show, along with a link to the Rational Reminder podcast, which I cannot recommend enough. Early in my career, my instinct on big market news was to react. I’ve grown up since then, and now I like to read books, listen to podcasts, watch movies, listen to music, or just about anything else.

Try to enjoy yourself, live and let live, try to be happy, enjoy your youth while you have it, and focus on saving a bit more, rather than trying to shoot the lights out with regrettable portfolio decisions.

—Avery

Spotify links to Paul Merriman and RR:

Rational Reminder on YouTube (with video):